Written by Scot Chisholm

| Founders, Leadership | May 17, 2024

Most companies screw up compensation design.

They struggle to balance base pay, bonus pay, and sales commissions – either making things too complex (you need a PHD to understand your comp plan), or too simple (there’s not enough skin in the game).

But most criminally, they fail to understand that compensation design is one of the most powerful tools a company has to create alignment between the company and every employee.

Do not forget this simple point: compensation drives behavior. Your compensation design incentivizes someone to act a certain way, to focus on certain things, to make certain tradeoffs. The way you design compensation will lead to either strong incentive alignment, or weak incentive alignment. And in the worst cases, a complete misalignment of incentives!

Here’s what Ray Dalio said about this recently:

100% – yet most companies get this dead wrong. Here’s the scenario that’s much more common:

The employee’s compensation has nothing to do with the company’s goals at all!

People are given raises, bonuses, or promoted for doing things on a day-to-day basis that are deemed favorable by their manager. But these “things” have no correlation to the company’s goals or success. So, you end up in a situation where the company could be failing, yet individuals are rewarded anyway. Or, the company is crushing it, but the individuals on the team aren’t allowed to participate in the upside.

Here are the most common mistakes I see companies making when it comes to aligning individual and company incentives:

You can avoid all of these issues with the right compensation design. And I believe that a company-wide bonus program is THE BEST tool at your disposal to align individual and company incentives.

Related side note: OKR enthusiasts completely miss this incentive alignment point as well. They insist that the OKRs should not be tied to compensation or promotion. This has always seemed insane to me. Why would you put so much effort into a goal system meant for alignment, and then make compensation decisions based on a completely different set of criteria? 🤷♀️

Incentive alignment isn’t a “nice-to-have”, it’s essential for any organization that’s serious about high performance. When the company wins, each person on the team wins – and this is a beautiful thing.

There are three main tools for aligning incentives through compensation:

This article focuses on the company bonus plan, but a quick thought about the other two.

Equity aligns incentives over the long-term (many years). The reward can be huge, but the risk of making nothing is also high. On the other hand, profit sharing and bonus plans align incentives over the short term (one-year periods).

I’ve found that using a combination of long-term and short-term tools leads to the best alignment across the team. However, not every company is in a position to grant equity. And a profit share program is inherently complex to manage (more on this in a separate post). So, I strongly favor the company-wide bonus plan. It can work for any company, of any size, in any industry. And if it’s designed well, it’s easy to understand for both the company and each person on the team.

Developing the perfect bonus plan took me years of trial and error. But in this article I’m going to share with you exactly where I landed after nearly 20 years of trying.

But first, some quick recognition: While the bonus structure in this post comes from my own experience, I scoured books, articles, blogs, public company filings, etc. as a source of inspiration. One company’s incentive structure that I found particularly helpful was ServiceNow. So, I want to give them some props for inspiring me to work so hard on getting this right!

Now let’s get into it!

First the basics. A bonus should not be confused with a base salary. These are two separate forms of compensation. The bonus is above and beyond a person’s base salary. You can think of a person’s compensation package like this:

Total compensation = Base Salary + Bonus

Most are familiar with base salary – the fixed amount that an employee gets paid for their work. This is typically paid every-other-week or monthly by the company, and is a guaranteed payment (unless the person leaves the company).

But the bonus portion is not guaranteed. You have to earn the bonus through strong individual and company performance in any given fiscal year. In other words, the company needs to achieve its annual goals, and the individual needs to achieve their own annual goals to unlock the full bonus (more on this later).

Use the right terminology

Given that the bonus is not guaranteed, it’s important to use the right terminology when describing a compensation package that includes a bonus plan. The wording needs to reflect the fact that the bonus is something you earn, not receive automatically. Here’s how to describe it:

Total earning potential = base salary + target bonus

With the following definition:

Total earning potential = the maximum compensation the person can earn in a fiscal year

Base salary = the fixed amount that’s guaranteed for payment

Target bonus = the maximum amount the person can earn through the bonus plan

Notice I replaced “total compensation” with “total earning potential”. And put the word “target” in front of the word “bonus”. These might seem like minor points, but the chosen words are important for setting clear expectations. You don’t want any miscommunication when you roll out the bonus plan.

The target bonus (dollar size) will vary based on role. For example, one person might have a $5,000 target bonus, and another person might have a $10,000 target bonus. There are two reasons for this:

But the methodology for calculating the bonus payout (what % of the target bonus you earn) is exactly the same across every person in the company – from the CEO to the lowest level person. So, if you take those same two people as an example, the process you follow to determine how much they earn (out of a $5,000 target bonus and a $10,000 target bonus) is the same.

The next section(s) focus on the bonus payout methodology. Then, at the end of the article, I provide a chart to help you determine the right target bonuses by role.

Remember that “target bonus” means the maximum bonus that a person can earn in any given year. So, the “bonus payout” is how much the person will ACTUALLY get paid based on performance.

Here’s the formula I use to calculate bonus payouts:

Bonus Payout = Company Payout + Individual Payout

Breaking this down further:

Bonus Payout =

Target Bonus ($) x [50]% x Company Performance (%)

+

Target Bonus ($) x [50]% x Individual Performance (%)

Where the [50]% is the weighting between company performance and individual performance. They are in brackets because you can technically change these weightings. But, after 20 years of trial and error, I highly recommend keeping it at 50/50. Equal weighting promotes a team-first environment while still fairly rewarding high performers. It’s the best of both worlds.

The company performance (%) is the percent achievement of the company’s annual goals. For example, a 100% would mean that the company achieved 100% of its annual goals.

Similarly, the individual performance (%) is the percent achievement of the individual’s goals. For example, a 100% would mean the individual achieved 100% of their annual goals.

Now let’s look at an example:

Let’s say an employee has a $10,000 target bonus. If the company achieves 100% of its goals (100% achievement), the employee earns a $5,000 “company payout”.

Then, if the employee achieves 100% of their individual goals, they earn another $5,000 “individual payout”.

The total bonus payout in this scenario would be $5,000 + $5,000, or $10,000. In other words, they earned 100% of their target bonus!

Now, you might be wondering, how do you measure company and individual performance? Let’s dive in…

In this section I’ll explain how to grade company performance, and ultimately calculate the company payout side of the Bonus Payout equation.

Here’s a reminder of the Bonus Payout formula. This section focuses on the parts highlighted in yellow.

Bonus Payout = Company Payout + Individual Payout

Or, the expanded version of the equation:

Bonus Payout =

Target Bonus ($) x [50]% x Company Performance (%)

+

Target Bonus ($) x [50]% x Individual Performance (%)

________

Company performance is graded against the company’s top 3 goals for the year. If you don’t have company goals, then you can’t grade performance. So, the first step is to make sure you have really strong company goals.

The company goals are set by the CEO and leadership team, and approved by the Board of Directors (if you have one).

Less is more here. By focusing on just 3 (or less) goals, you create laser focus across the company. Trying to tackle everything ultimately leads to tackling nothing.

Then, each goal should be challenging, but realistic. The company needs to believe that it can achieve the goal within a 12-month period.

Lastly, it’s imperative that each goal can be measured. You need to know with 100% certainty if the goal was achieved or not. And if it wasn’t achieved, how close were you?

Each of the three company goals is then weighted based on priority. Typically I’ll give each goal equal weighting, since they are all equally important. Here’s what this looks like:

Goal 1: 33% weighting

Goal 2: 33% weighting

Goal 3: 33% weighting

However, if one goal is a lot more important in any given year, you can give it more weight (meaning it will count more when calculating the payouts).

Here’s what this could look like:

Goal 1: 50% weighting

Goal 2: 25% weighting

Goal 3: 25% weighting

Since there are three goals, we need to determine the percent achievement and percent payout for each one. Then we just add them up to get the company performance percent %.

Here’s how you determine the percent payout for each goal based on percent achievement:

< 70% goal achievement = 0% payout

70 – 99% goal achievement = prorated payout

100%+ goal achievement = 100% payout (or more at company discretion)

The 70% threshold protects the company from paying bonuses for subpar results. But the pro-rata payout between 70-99% allows you to reward people even if the company hit 100% of the goal.

So, how do you calculate the prorata payout if the goal achievement falls between 70-99%?

Let’s assume the company achieved 82% of its goal. Here’s how you calculate the prorated payout for that goal:

(82% – 70%) / 30% = 40% payout

Just to make sure this part is crystal clear, let’s pick another number. Assume the company achieves 99% of its goal; then it would look like this:

(99% – 70%) / 30% = 96% payout

Now putting it all together, let’s say the company sets these 3 goals for the year:

1. Add $1M in new ARR (33% weight)

2. Launch 10 new features (33% weight)

3. Improve NPS from 20 to 40 (33% weight)

If the company achieves the following at the end of the year:

1. Adds $9M ARR (90% goal achievement)

2. Launches 8 new features (80% goal achievement)

3. Improves NPS to 40 (100% goal achievement)

You’d calculate the prorata payouts as follows:

1. (90% – 70%) / 30% = 67% payout

2. (80% – 70%) / 30% = 33% payout

3. (100% – 70%) / 30% = 100% payout

From here, you’d calculate the total company performance % like this:

Company Performance % = (67% x 33%) + (33% x 33%) + (100% x 33%)

= 22% + 11% + 33%

= 66%

So in this case every employee would earn 66% of the company portion of their bonus. At first glance, this can look harsh. But remember, in this example the company only achieved one of its top three priority goals for the year.

So the company should not be paying out enormous sums of money for underperformance. That would be like handing out participation trophies just for showing up. That type of thing is the enemy of high-performance teams!

So, back to the bonus payout equation. If their target bonus for the year was $10,000, and the weighting between company and individual performance was 50/50, then the company portion would look like this:

$10,000 x 50% x 66% = $3,300 company payout

Now onto the other half of the equation, individual performance.

In this section I’ll explain how to grade individual performance, and ultimately calculate the individual payout side of the Bonus Payout equation. Luckily, calculating the individual payout is very similar to the company payout.

Here’s a reminder of the Bonus Payout formula. This section focuses on the parts highlighted in yellow.

Bonus Payout = Company Payout + Individual Payout

Or, the expanded version of the equation:

Bonus Payout =

Target Bonus ($) x [50]% x Company Performance (%)

+

Target Bonus ($) x [50]% x Individual Performance (%)

________

Each employee in the company creates their own top 3 goals for the year. These goals must align with the company’s goals, and must be approved by their manager. Just like the company goals, each individual goal needs to be challenging but realistic. And they also need to be measurable. Once again, this is key. If they aren’t measurable, then the entire bonus plan formula will break down. I can’t stress this enough.

The individual and their manager can decide to add weighting to each individual goal (in the same way we did with the company’s). However, this is rarely done. The default is to simply weigh them equally.

At year-end, the manager grades the achievement of each goal. And they use the exact same scale as the company goals.

< 70% goal achievement = 0% payout

70 – 99% goal achievement = prorated payout

100%+ goal achievement = 100% payout (or more at company discretion)

Everything here is the same as the company performance % that we discussed in the last section. So for example, if an individual had the following results, and all three goals were weighted the same:

1. 95% achievement of goal 1 (33% weight)

2. 90% achievement of goal 2 (33% weight)

3. 60% achievement of goal 3 (33% weight)

You’d calculate the individual performance % as follows:

Individual Performance % = (((95% – 70%) / 30%) x 33%) + (((90% – 70%) / 30%) x 33%) + (((60% – 70%) / 30%) x 33%)

= 28% + 22% + 0%

= 50%

So, back to the full bonus payout equation. If their target bonus for the year was $10,000, and the weighting between company and individual performance was 50/50, then the individual portion would look like this:

$10,000 x 50% x 50% = $2,500 individual payout

Bonus Payout = Company Payout + Individual Payout

________

Now let’s bring this full circle and calculate the full bonus payout!

Using our example above:

We calculated the payouts for each side of the equation to be:

Company Payout = $3,300

Individual Payout = $2,500

Then the total bonus payout in this scenario is simply:

Bonus payout = $3,300 + $2,500 = $5,800

In this scenario, the employee earned 58% of their target bonus for the year. Not bad considering the company only achieved 1 out of 3 of its top goals; and the individual only achieved 1 out 3 of their own top goals (even if they were close). For a performance-based bonus plan, this result should feel fair to both parties.

When to pay bonuses

Assuming you operate on a calendar year (Jan 1 – Dec 31), you should expect to pay all bonuses by March 1st of the following year. I usually paid mine out during the last week in February.

Why? Because you need time to close the year, grade company performance and have each manager grade individual performances.

It takes less time to grade company performance, so I would usually communicate this earlier in the year (first two weeks of January). Then the managers grade the individual performance of each person on their team, and communicate the total bonus payout during a one-on-one.

If your company does annual performance reviews, then this is a great time to go through the bonus payout with each employee. It’s also a good idea to show them exactly how you calculate the payout amount using the formula in this article. This adds transparency and trust to the whole process.

It’s extremely important to set the right expectations with your team. Namely, base salary is guaranteed, bonuses are not.

But what should an employee expect to receive in any given year on average?

This is a fair and common question. On average, an employee will typically earn between 70-90% of their target bonus. In a crappy year, they could earn less than 50%, but in a great year they could earn 100% (or more for the highest performers, see below).

You should also make sure that the timeline is clear with the team. Each year they will learn what their bonus payout is, at or before their annual review in January or February. Then everyone gets paid their bonuses at the same time, prior to March 1st.

The company payout is never adjusted, but the individual payout can be. This is reserved for special cases of over-performance, or behavioral under-performance.

I typically give managers discretion to adjust the individual portion of the bonus payout depending on things like attitude, effort, teamwork, leadership, and other intangibles. They can adjust it up or down by 20% without approval, but anything further needs approval from an executive.

Adjusting the payout down

It’s rare to adjust the bonus payout down, but it does happen if there is a real behavioral issue with someone on the team. Out of every 100 people, this might happen with 5 or less people. Why so few? Because the formula itself already takes into account goal-based performance. A manager would only lower a bonus payout if the person exhibited significant behavioral under-performance – acting against company values, or somehow acting in a destructive fashion. It’s also best practice to pair the lowering of a bonus payout with a performance improvement plan. Together this sends a very clear message to the employee that such behavior will not be tolerated, and they must improve it immediately.

Adjusting the payout up

It’s more common to increase the individual payout for your highest performers. Typically I advise managers to identify their top 10% and increase each person’s payout by up to 20%. If one of the star performers already earned close to 100%, then the manager could push them over 100% with an upward adjustment. Out of every 100 people, there might be 10 or less that get their bonus payout adjusted upward. This is reserved for your very top tier performers, and sends them a clear message that you not only recognize, but reward excellence.

New hires get prorated bonuses based on their start date. This keeps things clean and fair.

For example, if a new employee starts with the company in June, and they have a target bonus of $10,000 for the year, the prorated amount would look like this:

Prorated target bonus = $10,000 x (6/12) = $5,000

Where the number six represents the number of months left in the year, and the number twelve represents the total number of months in the year.

The following year they would be able to earn the full $10,000 since they would be at the company for all 12 months.

You need to add the bonus plan to your annual financial plan each year – the total dollars that you anticipate spending on bonuses across the entire company. This is typically called the “bonus pool”.

Here’s how to calculate the bonus pool correctly:

This is the most conservative way to budget for the bonus plan because it assumes every single dollar is earned by the employee base. But this rarely happens because of the way the program is designed. Typically an employee will earn between 70-90% of their target bonus, which means that you should “beat the budget” every year (i.e. you retain more cash than you planned for).

By including the bonus plan in the annual financial plan, it also makes it easy for the Board of Directors to review and approve the plan ahead of time. This keeps everyone on the same page, and makes sure the full financial impact is always in full view.

Sales positions already have a variable piece to their compensation in the form of sales commissions. Their compensation formula typically looks like this:

Total earning potential = base salary + sales commissions

So, do you add a bonus plan too?

For sales reps and sales development reps (SDR, BDR, etc.), the answer is no. Most sales leaders would agree that they should be 100% focused on their sales comp plan only. Since they already have a strong risk/reward compensation design, there isn’t a strong need to add a bonus on top.

However, the sales leadership SHOULD be tied into the bonus plan program. Why? Because it keeps them aligned with other leaders across the company, and ensures they don’t prioritize the sales number over other company priorities.

But how could a sales number be in conflict with the company’s priorities? Consider this scenario:

One of the company’s top 3 goals for the year is to increase customer retention. It knows that small customers tend to churn at higher rates, so it wants to exclude small prospects from the sales funnel. But this will make it harder for the sales leader to hit their number. If the sales leader wasn’t tied into the bonus plan, the leader might fight this decision. However, since they will get compensated for increasing retention, they are now financially incentivized to make the harder choice and do what’s best for the company (not just the sale team).

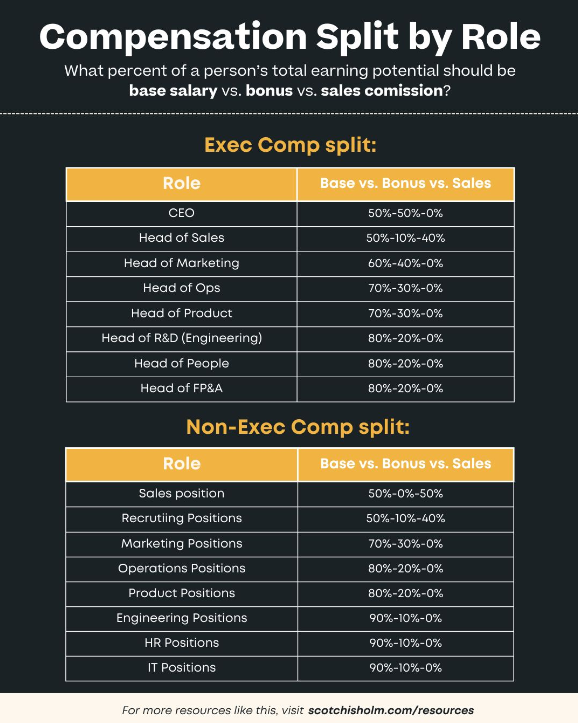

The split between base salary and bonus is different by function and role.

Executive compensation has a higher percentage coming from the bonus (vs. base salary). The logic here is that these leaders have more influence and control over the results. They also bear more of the risk. So there is more risk/reward designed into their compensation. This design also mitigates overpaying for under-performing executives. You pay for performance, and it starts at the top.

For the rest of the company, their base salary is a higher percentage of their overall compensation. In other words, more of their compensation is guaranteed. They have less influence and control over the company’s results, so they should have less risk/reward designed into their compensation.

And, as discussed above, sales positions are treated differently. Sales commissions replace the bonus plan for sales reps (account executives). But for sales leadership, they have a combo of base, bonus and sales commission.

So how does this compensation design compare to the market? And how do you communicate this to employees and potential hires?

There’s no “right” way to do this, since every company has its own compensation philosophy. However, here’s what’s worked for me:

This says: we pay well for showing up and doing your job, but we pay REALLY WELL for high performance.

While the bonus portion is not guaranteed, the average employee does earn between 70-90% on average in any given year. You’ll want to track your own data around this too, so you can back up this claim for potential hires. With a track record that you can show, potential hires will view the bonus portion as bankable, even if it’s not technically guaranteed.

This becomes significant when you’re battling another company for a great person. The total earning potential of your package may be higher than the competitive offer, but you need to prove that the structure isn’t just smoke and mirrors. If you can get them comfortable with how the bonus has paid out in the past, then you’re golden. This structure will only help you win great people, since they have no problem taking on a bit of risk for higher reward!

—

There you have it—a battle-tested bonus program that aligns your team and allows them to participate in the upside. It’s simple, transparent, and self-funding based on company performance.

Suddenly, every employee has a stake in the game. They start thinking and acting like owners. And this is the hallmark of a high-performance culture.

If you have any additional questions about this plan, feel free to reach out to me via my newsletter, or on social.

Are you a founder, executive, or manager? I’d love to support your professional growth.

Here are three ways:

Join 100,000+ leaders getting the blueprint to go from $0 to $100M.

Leadership, Management | June 28, 2024

No one likes annual performance reviews. Not the employee, not the manager, not the company. So why do so many companies still suffer the brain damage? Because, like so many things in business, “it’s the...

If you watch one thing this week, this should be it 👇 Ever feel like you’re working your ass off, but not making any real progress? It happens to the best of us. In the...

Leadership, Management | May 10, 2024

A-players don’t just “quit.” As a founder in the trenches for 20+ years, I’ve seen my fair share of A-players come and go. Most assume that star employees leave because of compensation or career advancement...

I'd love to learn more about you to better customize the tips I send, ensuring they are as relevant and helpful as possible.

Hi, I’m Scot — Join 100,000+ leaders getting

the blueprint to go from $0 to $100M.