Written by Scot Chisholm

| Founders | April 5, 2024

As a founder and CEO for nearly 20 years, I’ve raised hundreds of millions from startup investors. I’ve heard it all—the good, the bad, and the downright deceptive. Unfortunately, what you see isn’t always what you get when it comes to investors.

Most startup investors will tell you exactly what you want to hear to get a deal done. They’ll smile to your face, but as soon as the ink dries, their true colors start to show. Suddenly, all those lofty promises and glowing assurances go right out the window.

Much is written about founder “exaggerations” during the fundraising process. And, to be fair, this can certainly happen (see Theranos, FTX, etc.).

But here’s the harsh reality on the other side of the table: most prospective investors will stretch the truth or outright lie to your face during the fundraising process.

The key to success (and your sanity) is to cut through the bullshit before you sign on the dotted line.

To help you navigate this minefield, I put together 10 of the most common lies investors tell—and how to spot them from a mile away:

This has happened exactly zero times.

If an investor says they can wrap up a deal in 14 days, take that to mean 45 days minimum. The due diligence process alone typically takes 30 days minimum. Factor in legal back-and-forth, and it’s safe to at least double whatever timeline they give you.

But investors will tell you this because they know it sounds attractive. It’s like telling the founder, ” Our approval process is really easy,” which it’s not. Almost every investor needs sign-off from multiple partners, thorough due diligence, and legal red tape. All of this takes time—a lot more than two weeks.

But regardless, startup investors will still dangle a short timeline as bait. Don’t fall for it.

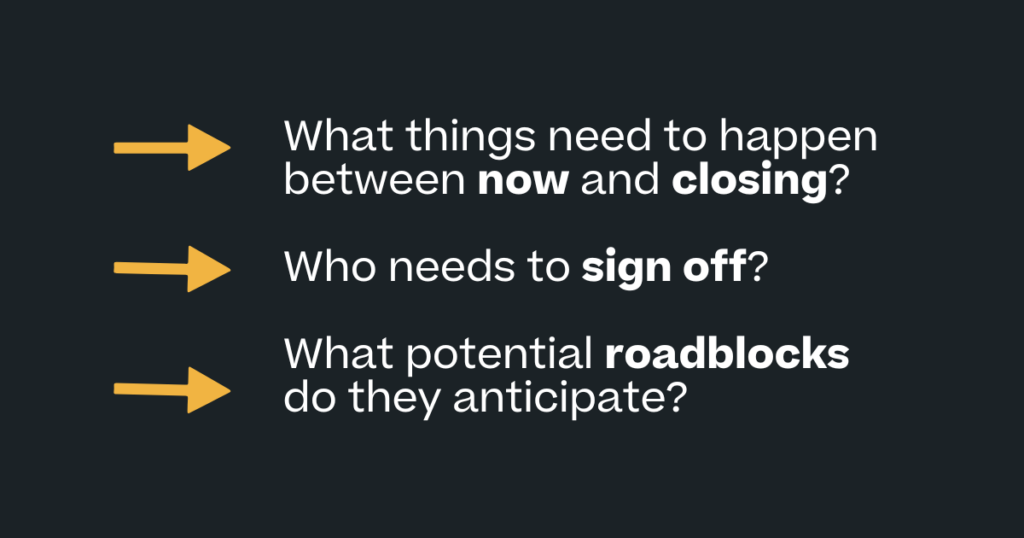

When an investor tells you they can close in a couple of weeks, push back a bit (respectfully). Ask them to walk you through their process step-by-step.

If they can’t give you detailed answers, they’re probably blowing smoke.

Every VC says this, but most deals are riddled with clauses that protect their interests over yours.

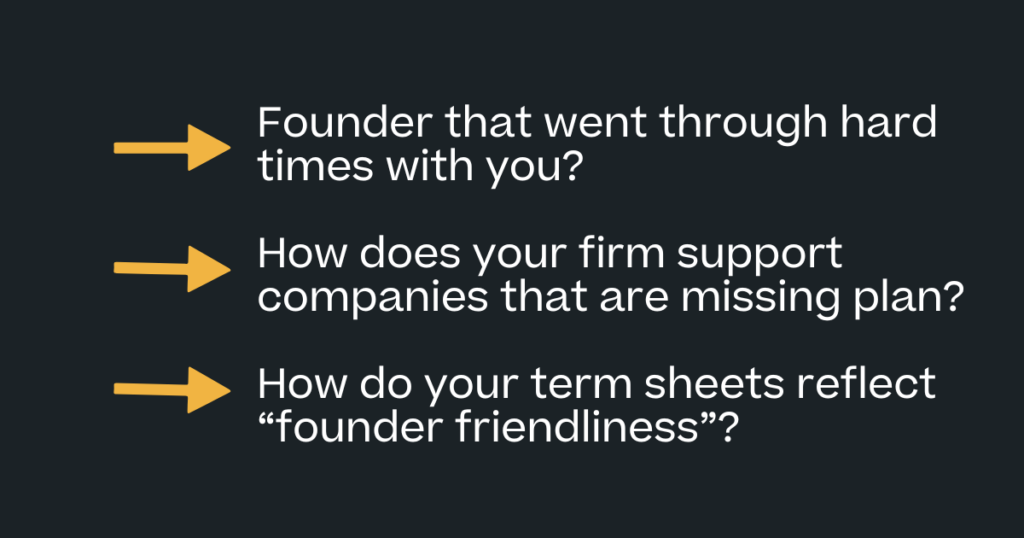

The real test of “founder friendliness” is how they act when the chips are down. Do they roll up their sleeves and help, or do they turn and start shooting their own?

The only way to know the answer is to do your homework. Talk to other founders they’ve backed, especially ones that ARE NOT on their referral list.

Find ones that have gone through tough stretches with the investor and ask how they behaved. Do they step up with additional support and resources, or do they micromanage and second-guess every decision?

Or worse, do they have a history of pushing the founding team out and replacing them with more “experienced” management?

When evaluating a firm’s founder friendliness, look beyond the surface-level perks like free office space or discounted benefits. Instead, focus on the core terms of the deal and the balance between founders, investors, and the broader team.

Can I speak to a:

Translation: They grabbed some scraps in a late-stage round right before the IPO.

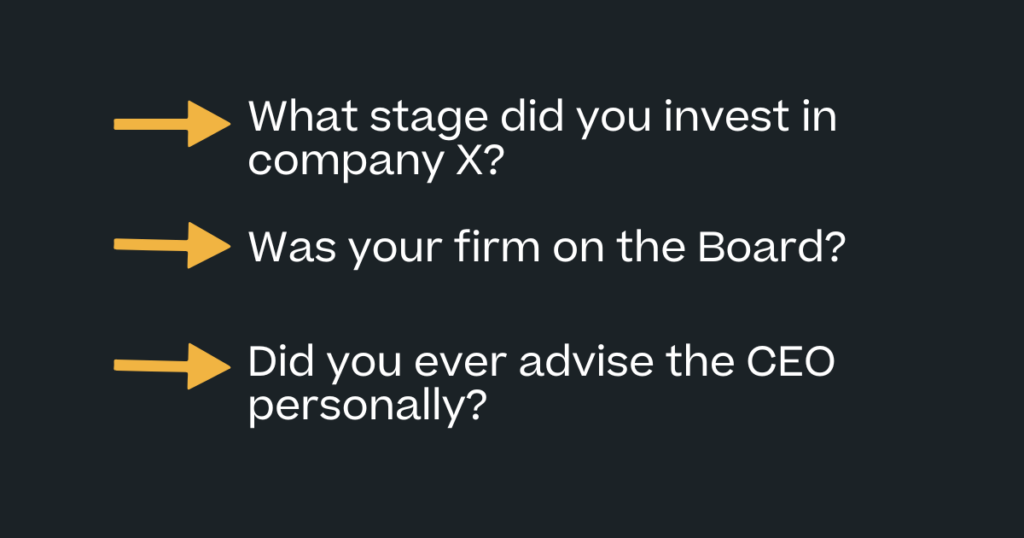

Many startup investors love to name-drop, especially if they have a few unicorns in their portfolio. But just because they wrote a check to a household name doesn’t necessarily mean they were instrumental to that company’s success.

The reality is late-stage investing is a very different ballgame than early-stage investing. It’s more about financial engineering than company building. Investors who specialize in pre-IPO rounds are often more focused on short-term exits than long-term value creation.

So don’t be wowed by big logos – dig into the details. At what stage did they invest? How much? What value did they add besides capital? A deep track record at the earlier stages is much more telling than jumping in at the 11th hour.

You should also try to suss out what unique value the firm brought to the table beyond just capital. The best early-stage investors roll up their sleeves and help in tangible ways. They don’t just ride coattails and then tout their “success” after the fact.

The concept of stage agnosticism sounds great in theory. It suggests a firm is flexible and adaptable, willing to invest in great companies regardless of where they are in their lifecycle. But in practice, it’s usually just a marketing gimmick.

There’s really no such thing as a “stage agnostic” firm. Every fund has an investment thesis centered around a specific stage and check size. Generalists rarely add as much value as specialists.

And different stages require different skill sets and resources from investors. Seed-stage investing is all about betting on people and ideas. It requires a keen eye for raw talent and the ability to provide hands-on support to help founders find product-market fit.

Series A-C investing is about helping companies scale and navigate rapid growth. It requires deep operational expertise and a rich network of potential customers and partners.

And late-stage investing is more about financial engineering and preparing for a liquidity event. It requires a different set of relationships and a keen understanding of market dynamics.

No firm can be all things to all companies. The best firms specialize in a specific stage and build a team and platform tailored to the unique needs of companies at that stage. They develop pattern recognition and domain expertise that allows them to add real value beyond just capital.

So when a firm claims to be stage agnostic, dig deeper. Look at the composition of their portfolio:

If their actions don’t match their words, be skeptical.

Which typically means we have a bunch of generic “best practices” that we peddle to every startup in our portfolio.

One-size-fits-all advice is rarely useful. Every company is unique. What worked for one company may not work for another, even if they’re in the same industry or at a similar stage. The best investors understand this and tailor their advice and support to the specific needs of each company in their portfolio.

Many investors tout their operational experience as a key differentiator. But the reality is that most investors have never actually run a company before—certainly not as a founder and CEO. This is one of the greatest ironies of the investor-founder dynamic. Pick the wrong investor, and you’ll be taking advice (or demands) from someone who has never been in your shoes before!

To counter this, ask plenty of questions about their prior operating experience:

The more specific and relevant the examples, the more credible their claim of operational expertise.

The venture capital industry is notoriously hierarchical. Associates are often the bottom rung on the ladder, tasked with sourcing and screening deals but not actually making investment decisions. Associates may have influence but not the final say. If you’re dealing with an associate, insist on getting a partner involved as early as possible.

The “stuck with an associate” dynamic creates a lot of frustration for founders. They could spend months building a relationship with the associate only to get an abrupt “no” (seemingly out of the blue). That’s the partner saying “no” behind the scenes because they were never bought-in in the first place.

So when an associate starts making promises about getting a deal done, be skeptical. Ask them directly about their decision-making authority:

If an associate is evasive or gives vague answers, that’s a red flag.

The best approach is to insist on getting a partner involved as early as possible. Don’t wait until the end of the process to find out where they stand. One meeting with just the associate is OK. But by the second meeting, I always want at least one partner there.

This may be technically true, but most will ask for one anyway (late in the process).

Giving up a board seat is a big deal. Most founders underestimate the importance of board composition in decision-making and maintaining control of the company.

First, you don’t want a bunch of non-contributing, non-responsive members on your board. This will delay decisions and make your job more difficult. You also don’t want an overly forceful board member – think “my way or the highway.” You’ll spend endless hours chasing down their recommendations with no results.

Board composition is also a huge deal in deciding who REALLY controls the company. Most founders think that equity (ownership percent) is how someone gains or loses control; but in reality, most of the control happens at the Board level. You can own a small amount of the company but have a seat on the board that gives you a lot of control.

So when an investor says they don’t require a board seat, take it with a grain of salt. Chances are, they’re just trying to downplay their deal requirements to make it seem more attractive.

The best way to handle this is to address it head-on during the early negotiation process (pre-term sheet). Don’t just assume you’ll figure it out later—make it a key point of discussion from the start. Ask the investor directly about their expectations for board involvement:

Investors say this when they want you to accept a larger check size from their firm. But raising excessive levels of capital comes with excessive levels of expectation. Overcapitalization can also spur undisciplined spending and de-risked thinking.

The “more is better” mentality is pervasive in the startup world, especially when it comes to fundraising. Founders are often judged by the size of their rounds and the prominence of their investors rather than the actual health and growth of their business. This creates a dangerous incentive to raise as much money as possible, even if it’s unnecessary.

And from an investor perspective, they will want to own as much as possible. The venture and PE community are sitting on MASSIVE funds and need to deploy this capital. So, they will often push you to raise more money than you actually need to get to certain ownership percentages.

This can lead to all sorts of unintended consequences. You might be tempted to spend money on flashy marketing campaigns or expensive hires that don’t actually move the needle. You might feel pressure to expand into new markets or product lines before fully nailing your core offering.

The best founders understand that fundraising is a means to an end, not an end in itself. They raise enough money to hit their next set of milestones with a healthy buffer, but not so much that they lose focus or discipline.

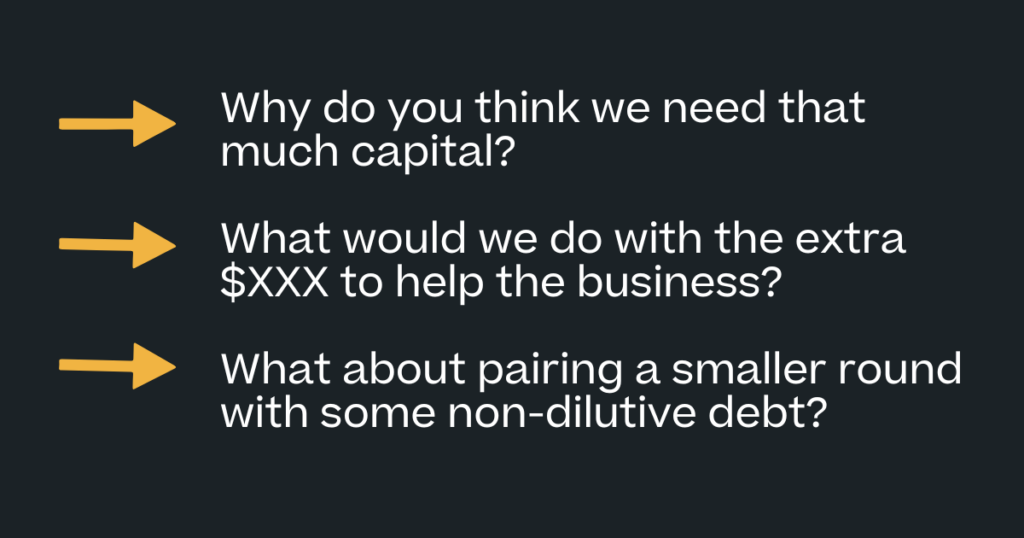

So when an investor tells you to raise as much as you can, push back.

Convincing an investor about the market size is one of the most challenging parts of any pitch. And in niche markets, the investor likely knows very little about your actual space. Top-tier investors will get ramped up quickly. Lower-tier investors will spin in circles for weeks (maybe months!!!) trying to “get their heads around” the market.

An experienced fundraiser will always gravitate towards investors with knowledge and excitement about their market. It feels pre-vetted.

When an investor leads with, “We’re really excited about your market,” this is what the founder hears:

“Great, I don’t have to spend endless hours debating the market with this one.”

But the problem comes later when the investor declines to invest because of the very market they said they were excited about in the first place! This happens more than you’d think.

Truth be told, market sizing is more art than science, especially for startups creating new categories. If an investor tells you they are already excited about the market, you should take that with a grain of salt. Assume they still know very little, and you’ll have to make a strong case for both the size and the competitive dynamics. If they end up knowing more, then bonus!

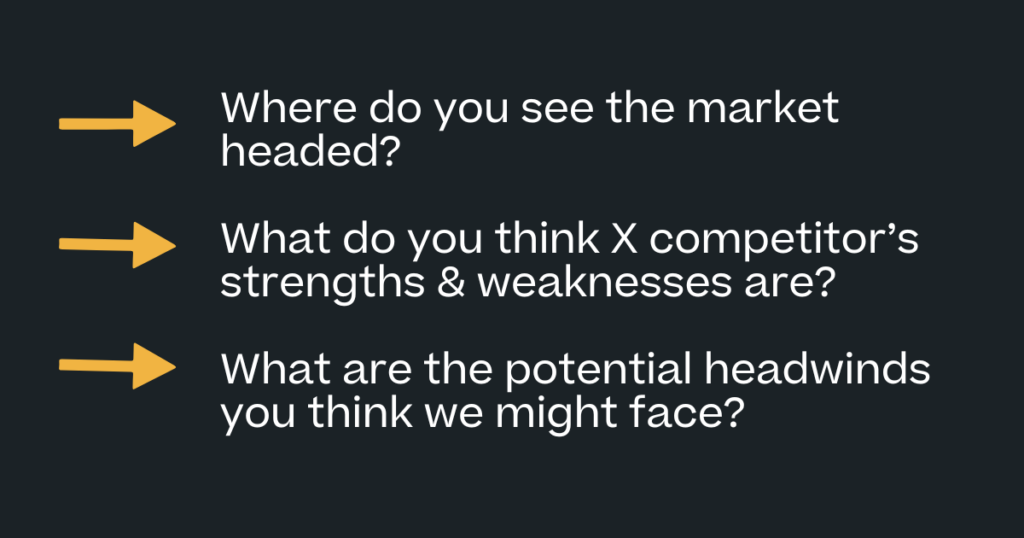

To gauge how much they really know, you can ask a few questions like this:

Here the investor is telling the founder that their fund is running out of money and they likely can’t invest.

But the “late in our fund” excuse is a classic investor dodge. If they lead with this line, it usually means they’re lukewarm on your company and want an easy way out.

Here’s the harsh truth, though: If they loved YOUR company, they would find a way to invest—even if it means stretching their ownership targets, bringing in co-investors, or even raising a small sidecar fund.

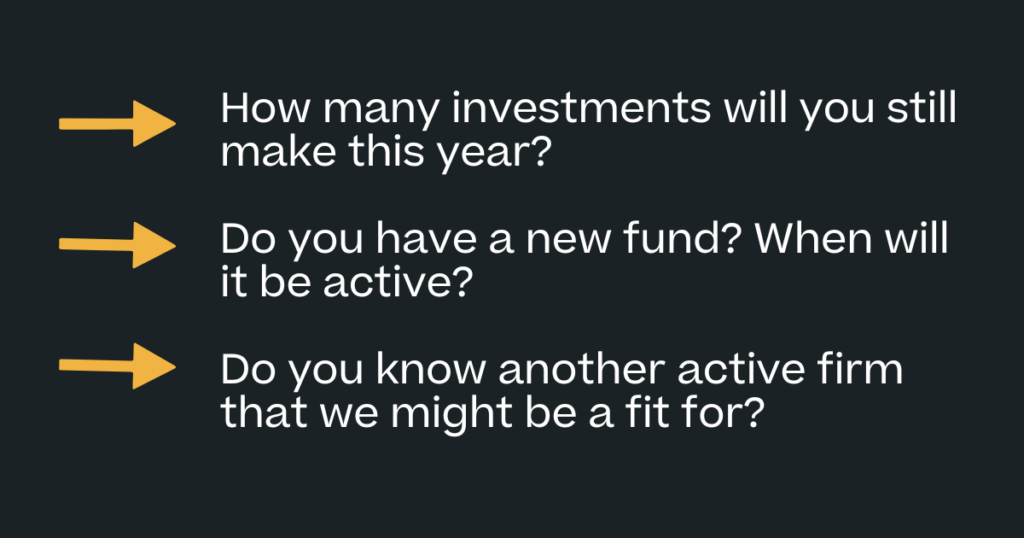

So, if you’re already fighting an uphill battle, you might as well dig in with these questions:

In the rare case that they are actually out of funds, you can always do one meeting with them and then ask for a referral to an investor they respect. And always stay in touch, they will likely raise another fund in the future!

—

Remember that investors are savvy salespeople. They know how to push the right buttons to win over founders. Your job is to cut through B.S. and enter the negotiations with eyes wide open.

How an investor treats you during the courting phase is often their best behavior. That’s why you should maintain a healthy skepticism and never fall for empty flattery. Always pressure test their claims and take their promises with a grain of salt.

Some extra work upfront will save you a ton of pain later!

Are you a founder, executive, or manager? I’d love to support your professional growth.

Here are three ways:

Join 100,000+ leaders getting the blueprint to go from $0 to $100M.

If you watch one thing this week, this should be it 👇 Ever feel like you’re working your ass off, but not making any real progress? It happens to the best of us. In the...

Founders, Leadership | May 17, 2024

It’s all about incentive alignment… Most companies screw up compensation design. They struggle to balance base pay, bonus pay, and sales commissions – either making things too complex (you need a PHD to understand your...

Founders, Ops | April 19, 2024

You are what you schedule. As a leader, your time is your most valuable asset. So, the difference between good and great leadership is how you use your time. That makes your calendar one of...

I'd love to learn more about you to better customize the tips I send, ensuring they are as relevant and helpful as possible.

Hi, I’m Scot — Join 100,000+ leaders getting

the blueprint to go from $0 to $100M.