Written by Scot Chisholm

| Founders | January 12, 2024

I sacrificed compensation for too long early in my entrepreneurial journey.

Almost four years after founding Classy, I was sleeping on the floor of a one-room apartment with my co-founder because we couldn’t pay rent. That was our low point.

Yes, there will be times when you need to fight and be scrappy, but being frugal shouldn’t mean neglecting your basic needs.

On the other hand, you shouldn’t be jumping on private jets to see your clients either…

Moderation is key. It’s about finding a balance that aligns with your company’s stage and your personal well-being.

Your Board doesn’t want CEO & founder pay that becomes an expense boat anchor. But savvy Boards will almost always pay for high performance.

If you get this balance right, it’s a win-win for both the company and the founder. That’s what we’re going to explore in this article.

As a founder, you wear many hats.

There are a million and one things you need to worry about, from product development to sales to hiring. Most founders’ compensation package is usually not top of mind.

But it should be – at least until you get a structure that works.

First, health & wellness. Startup founders are like professional athletes. They need to be at the top of their game to succeed and can’t do that if they’re worrying about paying rent and eating like crap. A healthy and balanced leader at the helm is well-equipped to steer the ship forward.

Second, it signals that you respect yourself and recognize the value you bring as a leader. This earns you respect in return. As CEO, you have to set that standard.

Third, having the right founder compensation package from the start sets up your relationship with the Board for long-term success. It communicates mutual expectations, aligns incentives, and shows you’re clear about what you want.

Not doing this at the beginning is like setting off on a harrowing journey without a map to guide you. You may get lucky, but odds are it’ll come back to bite you.

But don’t just take my word for it. Here’s what the Harvard Business Review had to say about the importance of your comp package:

Compensation policy is one of the most important factors in an organization’s success. Not only does it shape how top executives behave, but it also helps determine what kinds of executives an organization attracts.

So, while cash is tight in the early days, make compensation a priority discussion with your Board (or with your co-founders if you don’t have a Board).

Align on a philosophy and structure that incentivizes the behaviors you want to see from yourself and your leadership team. But don’t treat it as a zero-sum game. Treat it as an infinite game where all parties can participate in the upside.

The ideal compensation package I outline below has worked brilliantly for me across my portfolio of companies. It’s a structure I wish I’d known about years ago.

Several key factors influence the ideal numbers and specifics. Think of it like a formula, where the variables can be affected (up or down) by the following:

Remember, it’s a formula with variables. Don’t get wedded to the specific numbers below.

Instead, use this framework as a strong starting point for negotiations. But be ready to tweak your numbers up or down by 20-30% based on your unique situation.

Ready to dive in? 👇

Your base salary is the stable foundation of your compensation – your bills today aren’t paid by future compensation. Base salary should reflect the company’s stage of growth. As the company grows, so does your base salary. Here’s a guideline:

This model helps you conserve cash early on, which is the second most common reason for startup failure, affecting 29% of failed startups. But it also gives the founder (and the Board) visibility into how the base will grow over time—a mutually agreeable roadmap.

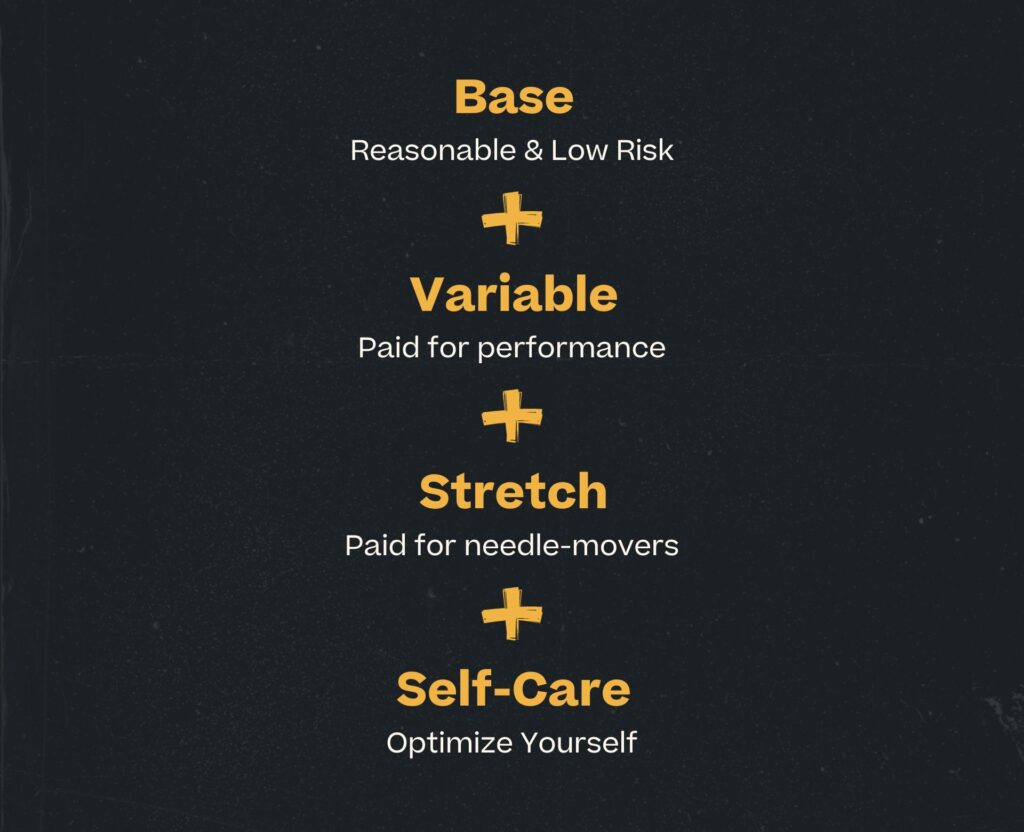

Variable compensation is the first performance-driven part of your package. You should be able to 2x your base startup founder salary for hitting the company’s top goals.

Here’s what to do:

Then hit the goals and earn your variable comp:

Make sure the goals are S.M.A.R.T. – Specific, Measurable, Achievable, Relevant, and Time-bound—no point in having goals that feel impossible to reach or measure.

Great incentives align great interests. Don’t just meet expectations. Look to smash them.

Stretch Goals are (3 or less) additional targets that go beyond the ordinary course of business and help the company make quantum leaps forward.

They are typically forward-looking goals and/or Board priorities only the CEO can drive.

Examples include:

Stretch goals motivate the CEO to go above and beyond their regular duties.

It incentivizes you to look for those level-changing opportunities.

This piece is almost always overlooked, but it really shouldn’t be.

According to Forbes, 72% of founders report that entrepreneurship has impacted their mental health. Your physical and psychological well-being is critical for your success as a founder and the company’s success.

It should go without saying that the Board should help you optimize your health and performance. Professional athletes have strength, nutrition, and recovery plans…

Why shouldn’t the founder & CEO?

Get the Board to fund:

And if your Board has never heard of a self-care package, have them call me. This should be a standard for all founder compensation. There is no bigger win-win.

With the right base salary, variable compensation, stretch compensation, and self-care, this structure sets you and your company up for a win-win.

Example: Base ($75k) + Variable ($75k) + Stretch ($37.5k) + Self-Care ($12k)

You should present this structure to your Board as early as possible. I’d be surprised if they didn’t see it as a win-win.

If they don’t, take it as a yellow flag and ask to review again at the turn of the year (when annual budgets are set).

If they still don’t entertain it, take that as a red flag and reach out to me. I’ll coach you through it.

Presumably, you already have a good amount of stock as a founder (and possibly CEO).

If you don’t, for some reason, negotiate the equity separately based on your unique situation and the type of company you’re building. The same principles apply: Tie additional equity grants to company performance and agree to a vesting schedule. This de-risks things for the company while setting you up to earn more if the company performs under your watch.

And what is the ideal time to negotiate more stock options? During a new fundraising round – but that’s a lesson for another time.

Remember, your well-being and performance are crucial to the company’s trajectory. A well-structured compensation package isn’t just about your personal gain; it’s about ensuring the leader is well-equipped to steer the ship forward.

—

Are you a founder, executive, or manager? I’d love to support your professional growth.

Here are three ways:

Join 100,000+ leaders getting the blueprint to go from $0 to $100M.

If you watch one thing this week, this should be it 👇 Ever feel like you’re working your ass off, but not making any real progress? It happens to the best of us. In the...

Founders, Leadership | May 17, 2024

It’s all about incentive alignment… Most companies screw up compensation design. They struggle to balance base pay, bonus pay, and sales commissions – either making things too complex (you need a PHD to understand your...

Founders, Ops | April 19, 2024

You are what you schedule. As a leader, your time is your most valuable asset. So, the difference between good and great leadership is how you use your time. That makes your calendar one of...

I'd love to learn more about you to better customize the tips I send, ensuring they are as relevant and helpful as possible.

Hi, I’m Scot — Join 100,000+ leaders getting

the blueprint to go from $0 to $100M.